AARP Hearing Center

- AARP Online Community

- Games

- Games Talk

- Games Tips

- Leave a Game Tip

- Ask for a Game Tip

- AARP Rewards

- AARP Rewards Connect

- Earn Activities

- Redemption

- AARP Rewards Tips

- Ask for a Rewards Tip

- Leave a Rewards Tip

- Help

- Membership

- Benefits & Discounts

- General Help

- Caregiving

- Caregiving

- Grief & Loss

- Caregiving Tips

- Ask for a Caregiving Tip

- Leave a Caregiving Tip

- Entertainment Forums

- Rock N' Roll

- Leisure & Lifestyle

- Health Forums

- Brain Health

- Healthy Living

- Medicare & Insurance

- Health Tips

- Ask for a Health Tip

- Leave a Health Tip

- Home & Family Forums

- Friends & Family

- Introduce Yourself

- Our Front Porch

- Money Forums

- Budget & Savings

- Scams & Fraud

- Retirement Forum

- Retirement

- Social Security

- Technology Forums

- Computer Questions & Tips

- Travel Forums

- Destinations

- Work & Jobs

- Work & Jobs

- AARP Online Community

- Health Forums

- Medicare & Insurance

- Re: Delta Dental --Please have AARP officially rep...

Delta Dental

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

I have Delta Dental thru AARP and had it for a few years. This hasn't been updated with coverage for a long time. The way Dentists have been charging nowdays, your out of pocket cost keep going up and the coverage amount per year stays the same. I would be willing to pay more for at least 2500 or 3000 coverage.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

There are many organizations who look for programs that their members can use. If they do their job well the program will perform well, and be cheaper than what you would pay if you paid the provider direct. Discounts in dental services is quite common now. There are programs which are just discount. The sponsor of the program will usually help a member if they have problems. They work closely as an employer plan does which can be insurance or discount or both.

I have a program from my employer which is discount and insured. If you use an in network dentist you the discount on top of the insurance. The discount is 20%. I pay $10.00 per month. I have saved every year. The dental exams and teeth cleaning 2 times per year are free. While traveling I had to see a Dentist and that was fully covered. You can save money with the right program.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

Sadly, I have found this to be the case with every single thing which they claim to be discounted - life insurance, auto rentals, Consumer Cellular, and on and on. For Consumer Cellular, I save less than $2/month. If they’d spend less on all the environmentally unfriendly paper garbage they send me touting these discounts, perhaps they could get serious about actually saving us seniors some money.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

I'm new here but have been looking for a new dental plan once I go off my retirement plan (retired in 2019) and start Medicare in early 2022. I live in Illiinois. Of all the companies offering dental coverage, only Delta Dental had a plan with annual maximum of $2500, which matches my employment and retirement plan (the employer's group plan seemed pretty generous).

The quoted monthly premium was ~$45 ($540 annual). With a previous history of continuous dental coverage, Delta Dental would wave any waiting periods, so everything would kick in immediately. My present dentist provided me with the out-of-pocket costs of procedures so that I could compare the different between have insurance and paying cash.

For routine preventative work twice a year, cost having Delta Dental would be $540. Cash approach would be $311. So one would save $229 paying cash.

But as I have multiple teeth with fillings and a recent crown last year, I decided to examine that kind of scenario. Cost with Delta Delta would be $540 (annual premium) plus $75 deductible plus $750 (50% of $1500, table of allowance for crown procedures) = $1365. Cash approach would be $1977 for the single crown procedures. So Delta Dental would save $612. If one added in the preventative care, $311, that would have been $2288 cash or a savings of $923 by having Delta Dental insurance with the high annual maximum benefit. It would take 4 years of simple preventative care to break even by paying cash.

So the decision would require an estimation of risk. Should one anticipate additional crown procedures or root canal or fillings or dentures or implants? Is it worth the risks to obtain insurance or pay cash? In many ways, this would be similar to the decisions about auto or medical insurance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

@KennethB935316 wrote:Why is purchasing dental insurance directly from Delta Dental cheaper than buying it through AARP? I thought AARP was supposed to help seniors not penalize them.

I'm not certain if AARP is penalizing seniors and charging usurious rates for insurance. Some investigative reporter might be able to dig up the dirt on that. Or maybe some hard questions presented directly to the AARP.

In any case, your question piqued my interest and I did some research on this insurance. I wanted to compare "apples to apples", or at least as much as I could...so that any differences would stand out.

I went to the sites for the AARP plan from Delta and to the regular Delta Dental site. There were multiple plans available so I picked one from each site that seemed to be mostly comparable, and these were the "premium" plans. I entered data for my own zip code (others may vary) and age.

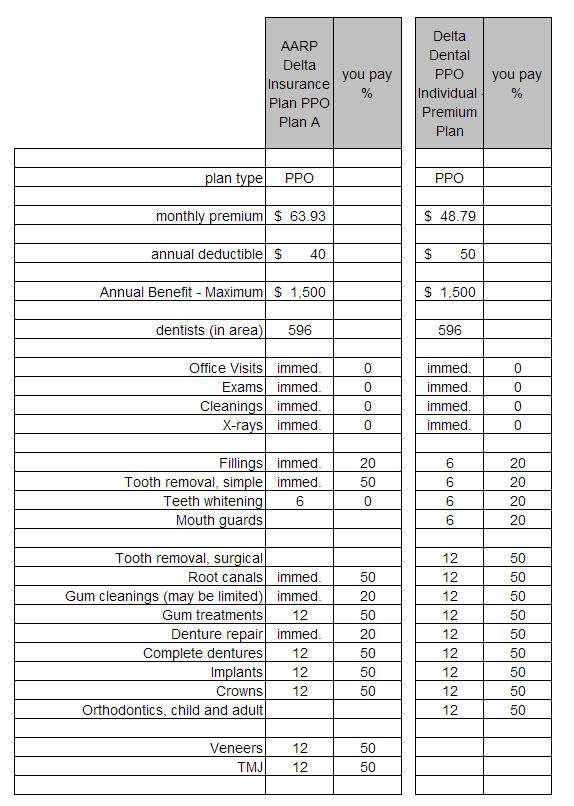

Basically, these were:

(1) AARP Delta Insurance Plan PPO Plan A ... $63.93 per month

(2) Delta Dental PPO Individual - Premium Plan ... $48.79 per month

Thus the AARP plan is around Fifteen Bucks more per month ... around 30 % higher!

But let's look at the details and compare the two plans. This table shows the major details of the plans from the websites. Mostly the two plans have comparable specific benefits but not always (for example, AARP plan does not provide orthodontics, the Delta plan doesn't provide veneers). Note that I only transcribed the main features of the plans as shown on their websites, the "fine print" may cover more detail.

From the table it's apparent that the AARP plan more services "immediately" (noted as "immed." in my table). On the other hand some such services, such as tooth removal is covered earlier with the AARP plan (immediately versus 6 month wait) but you must pay more money: 50% of fee versus 20%.

It seems to me that the AARP plan is comparable overall to the Delta plan. A number of benefits are offered sooner with the AARP plan, so this would be expected to cost more. And the AARP plan picks up more for some services. On the whole I think the added benefits/features of the AARP plan are probably justified when compared to the Delta plan. Thus I don't feel that AARP is "ripping us off".

Someone probably could save some dough by going with the Delta plan and living within its longer waiting periods (I imagine that these don't matter after the first year on the plan).

On the other hand, to pay around $600 to $730 a year just to be able to get a maximum return of the $1500 maximum benefit does not seem like a bargain to me. I myself use a plan recommended by my dentist which provides for lower professional fees but I am always paying "something". Should the annual charges exceed $1500 I would be ahead (a place I am not currently at). But in any case the cost is much less than that for "insurance".

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

@fffred over 45 years in the insurance business and I have NEVER seen a dental plan I would buy for myself. IMO dental coverage is a complete waste of money.

The two plans you put up side x side may or may not be the ones @KennethB935316 was comparing.

The waiting period is one thing that creates a lower premium for the Delta plan. Also the copay on tooth removal. May or may not be an issue with teeth that are 65 yrs old.

Also the AARP/Delta plan has a shorter waiting period for root canals.

Ortho covered by Delta (direct) but not AARP. Probably not something folks 65+ are interested in, so I would rate this a "non-issue".

Some folks who call me about dental are often looking at extraction and implants. Both plans have a 12 month wait for implants but AARP has immediate coverage for extraction, Delta direct a 6 month wait

Are you going to have a tooth pulled then wait 6 to 12 months for the implant? You do need SOME time between extraction and implant. Is 6 months enough or is 12 preferred?

Can't say. I am not a dentist and haven't seen your mouth.

FWIW one extraction and implant will probably deplete your annual max.

I have a lady who needed half a dozen (or more?) teeth pulled and replaced with implants. She called around and found a dentist who gave her a "good" price and she didn't have to do the work over 6 years.

I can tell you from experience when a tooth goes bad you want it done sooner vs later. Otherwise it can abcess and then you have a REAL problem.

Don't waste your money on dental coverage. Pay out of pocket. That's what I do.

Bark less. Wag more.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

I recently visited on "in-plan" dentist for repair of a resin filling on a lower second molar. I was in my second yr dentegra membership, where fees are to decrease. I asked the billing person what it would cost if I didn't have aarp Dentegra Propel plan. She quoted a figure $150 higher than what Dentegra paid. Only I cant figure out what Dentegra will pay from their very difficult to interpret statements online. I pay about $700 per year for teh AARP sponsored plan.

I asked dentegra why they couldnt issue the statement as a downloadable ONE-PAGE pdf. They said I had to "file a grievance" to ask that. What do members w/o computer access do? The online statement requires members to click on a dozen different boxes to get "more info" about their claim. That's outrageous!

this is the SECOND time I've chosen an aarp approved health plan. You can get AARP Medigap w/UHC. Another expensive insurance with big monthly premiums for little benefit. I have few medical conditions. I dropped it and switched to Advantage.

The NYT recently ran an article on dental plans agreeing with somarco's findings.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

@somarco wrote:@fffred over 45 years in the insurance business and I have NEVER seen a dental plan I would buy for myself. IMO dental coverage is a complete waste of money.

The two plans you put up side x side may or may not be the ones [op] was comparing. .

My intent was to demonstrate what you yourself indicated in your first reply, that the difference in premiums likely had a legitimate explanation rather than nefarious. Given the lack of information in the original post I could not go through comparison of numerous plans, I only wished to present a side-by-side comparison of a representative set of dental plans and draw some conclusion from the investigation. Any interested parties (such as the OP) would then be welcome to perform the same exercise having been shown how to do it.

I suppose I was simply calling the OP's bluff. He was complaining about AARP abusing members with the insurance ("I thought AARP was supposed to help seniors not penalize them"). I wanted to show if this was true or not. I doubt that it is true.

Edit: I should have added to my first post the term/disclaimer that was invented just for this use... YMMV. Your mileage may vary.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

So do you think that many members of this group think that when AARP offers a plan through an insurer of some type or actually some retailer of a service, that the 1st thing they think of is that it is CHEAPER?

That is not the way AARP Services, Inc. works - they develop a plan with and insurer or other retailer of service that is suppose to be a good value to seniors by its offerings - that does not necessarily mean it is cheaper.

Roseanne Roseannadanna

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

Ahoy Gail! :- )

@GailL1 wrote:So do you think that many members of this group think that when AARP offers a plan through an insurer of some type or actually some retailer of a service, that the 1st thing they think of is that it is CHEAPER?

Your guess on this is as good as mine is.

I am often surprised at the complaints and expectations I see posted in the forums regarding various services that may relate to AARP "somehow". I am of the "buyer beware" mindset and if it sounds too good to be true I will give it the ol' eyeball.

Now, the OP here in this thread wasn't too caustic about AARP in his original remarks. But they did prompt me to do an actual investigation into this to try to get some actual facts (what a concept? And I know that you do this all the time... posting the actual facts on an issue...lots of research and it is highly appreciated by me and others).

But I have seen other threads in other sub-forums just castigating AARP...often for services that aren't even under their control! ("oh, your Windows is not working? we'll get right on it, sir. AARP will fix it right up.")

For instance, there's another thread "just below" in this subforum also about Delta Delta. It's full of some hot feelings. I wonder if the really angry people have actually investigated what their particular policy provides?

So, that's me. Just trying to crunch numbers, list comparative facts (1) Maybe some people will take this to heart and see that they can actually do this themselves. (note 1: I have tried to do that a number of times in the Social Security forums... crunch numbers for posters' particular situation and let the results speak for themselves).

That is not the way AARP Services, Inc. works - they develop a plan with and insurer or other retailer of service that is suppose to be a good value to seniors by its offerings - that does not necessarily mean it is cheaper.

Sounds good. I think you're preaching to the choir here, I basically accepted that principle even before I knew. I think the OP is the one who needs this lesson (and a number of other forum posters). Possibly it's worthwhle describing this a bit more fully and putting up as a new post/thread. I would nominate for that "hall of fame" .. The "Ideas, Tips, and Answers" forum ...where they put up the best informative posts. Edit to add: Oh, that would be so convenient! Then when someone complains about AARP and services they could be directed to that "Tip", if applicable.

p.s.: stay safe during this crazy time of the virus

I feel (and this discussion verifies) that Delta Dental is providing an inferior service.

The time for us "members" to talk about it is through; we should hear from the AARP rep who selected and approved Delta Dental. That person should explain:

- Why Delta was chosen

- Why it costs more than buying it through AARP than going it alone

- What about its inferior quality; e.g. that appeals can only be done via US mail (see below)

- What will AARP do about this quality control issue

I had a claim which was denied, and was told by Delta Dental that it can only be done by USPS and not by phone, fax or email. That was in ref number 127235527915.

I was given a fax number by a later phone call (ref # 127287291483. She said that appeal phone # was 717-691-7356. I tried it and it did not work. I called Delta again, and Sheila answered and she found out there was only that one fax which wasn't working. Sheila found out they would not give her an alternate fax, phone or email.

As I wrote in my letter of today Aug 11,2020:

You [Delta Dental] are purposely refusing to accept phone calls, emails or faxes [in order] to slow down the appeals, by using a 1700’s technique of communication (Ben Franklin was the postmaster), instead of 1800’s phone call, or 1900’s faxes and emails.

"I downloaded AARP Perks to assist in staying connected and never missing out on a discount!" -LeeshaD341679