AARP Eye Center

- AARP Online Community

- Games

- Games Talk

- SongTheme

- Games Tips

- Leave a Game Tip

- Ask for a Game Tip

- AARP Rewards

- AARP Rewards Connect

- Earn Activities

- Redemption

- General

- AARP Rewards Tips

- Ask for a Rewards Tip

- Leave a Rewards Tip

- Caregiving

- Caregiving

- Grief & Loss

- Caregiving Tips

- Ask for a Caregiving Tip

- Leave a Caregiving Tip

- AARP Help

- Membership

- Benefits & Discounts

- General Help

- Entertainment Forums

- Rock N' Roll

- Let's Play Bingo!

- Leisure & Lifestyle

- Entertainment Archive

- Health Forums

- Brain Health

- Conditions & Treatments

- Healthy Living

- Medicare & Insurance

- Health Tips

- Ask for a Health Tip

- Leave a Health Tip

- Home & Family Forums

- Friends & Family

- Introduce Yourself

- Housing

- Late Life Divorce

- Our Front Porch

- Home & Family Archive

- Money Forums

- Budget & Savings

- Scams & Fraud

- Retirement Forum

- Retirement

- Social Security

- Retirement Archive

- Technology Forums

- Computer Questions & Tips

- About Our Community

- Travel Forums

- Destinations

- Work & Jobs

- Work & Jobs

- AARP Online Community

- AARP Help

- General Help

- Re: BEWARE of Hartford Auto BAIT and SWITCH

BEWARE of Hartford Auto BAIT and SWITCH

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

BEWARE of Hartford Auto BAIT and SWITCH

I switched to AARP Hartford Auto Insurance last year. The premium for the first year was very attractive saving us about $200 compared to our previous carrier.

BUT, when the policy renewed after the first year, Hartford has raised the premiums by 28%. I have no claims, perfect driving record, and no changes to the policy. Hartford customer service has no credible explanation for the increase. This looks like a classic BAIT and SWITCH to me. I am hugely disappointed in Hartford and will be switching insurance again after getting some new quotes from different companies. AARP should seriously look at what businesses they endorse.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

YES - Definitely bait and switch! They did the same to me and, when asked, said the medical care and car repair costs have gone up. They wanted to raise my rates (perfect driving history, no claims) by 38.65%. But luckily for me - so they say - since I obtained the 23% discount for participating in the HORRID 6-month tracking program (that's another story!), my insurance will only increase slightly this year upon renewal. AARP should drop their sponsorship of this fraudulent insurance. Looking online, insurance rates are ACTUALLY only up 8% in 2023 from 2022 - NOT 36%+. The agent said "everything's going up - have you been to the grocery store lately?" - as though I'm dumb and needed placated to believe this nonsense. I may be older, but I'm definitely wiser. BAD COMPANY

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

thanks for all the kudos lattitude, if youwant to have some fun/frustration, call upsome exec's in the AARP org.....ask them to reveal how much Hartford is paying them for it's "endorsement"and "branding rights" (multimillions I bet) they won't reveal it, try to chnge the subject, try to act all concerned, say they'll look intoit...in the end...members are thrown under the Hartford bus, so AARP exec's can ride that bus wth profits and high salaries...NOT WORKING FOR MEMBERS BENIFIT.

Know a good lawyer? i will provide them incontrovertable documented evidence of nearly double the cost of house and car insurrance for same identical coverage.

AARPHartford did the same thing to me, increased my auto insurance, almost double, for no apparent reason. When I called to ask, why this is happening they didn't provide me with a valid answer. They only said "Sorry I don't have an answer". AARP should look into their relationship with THE HARTFORD.

AARP re-focus it should be about the membership.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

Nekaj. so go to allstate and you will get the same insurance you had at very close to the old price you were paying. much much less that Hartford....I just got AARP magazine, and Hartford purchases full page adds touting their insurance: "Saves new customers an average of $550 less when they switch to us from Allstate" LIES! a blatant lie.....its Hartford that charges double! and AARP sells their endorsement to this price gouging corporate crook. HOW MUCH IS HARTFORD PAYING YOU MANGERS OF AARP? (they won't answer), AARP keeps the millions from Hartford payola that is more important to them then doing their job for the membership of AARP that pay dues to employ them...they sell us out to the highest corporate bidder, who then price gouges seniors

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

Hi there! AARP Member Benefits Team here to help. We certainly understand your concern regarding the rate increase of your Hartford Auto insurance policy. We’d be happy to forward your concern to the Escalation team we work with at The Hartford for their thorough review and investigation if you’d like, as there are a multitude of factors that impact your rate. To do this, we will need more information. Please send me a private message in the AARP Online Community by clicking this link and entering my username, “LakeishaT901230” into the “Send to” box https://community.aarp.org/t5/notes/composepage

Please provide the following details in your message:

- AARP membership number (or home address)

- Best contact phone number

We apologize for the inconvenience and appreciate you informing us of your concern. We look forward to hearing from you soon!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

thanks...glad I found allstate, saving me $1250 annually.....the big question I'd like to know is how many $million$ does Hartford give to the AARP org for their endorsement.? I wish my AARP org worked for me, getting me the best rates as a group--instead, they apparently, just sold us out to the highest corporate bidder

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

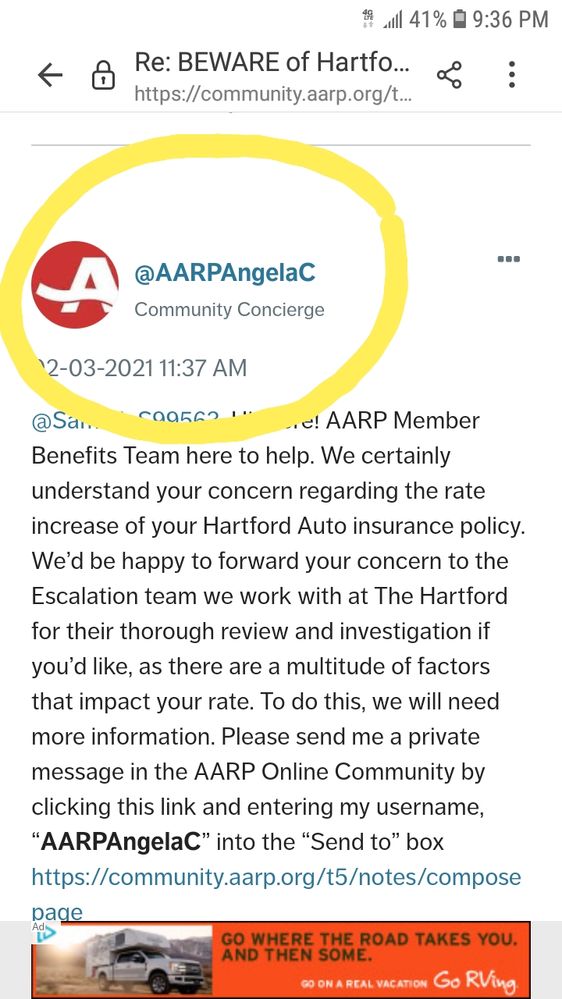

@SammieS99563 Hi there! AARP Member Benefits Team here to help. We certainly understand your concern regarding the rate increase of your Hartford Auto insurance policy. We’d be happy to forward your concern to the Escalation team we work with at The Hartford for their thorough review and investigation if you’d like, as there are a multitude of factors that impact your rate. To do this, we will need more information. Please send me a private message in the AARP Online Community by clicking this link and entering my username, “AARPAngelaC” into the “Send to” box https://community.aarp.org/t5/notes/composepage

Please provide the following details in your message:

- AARP membership number (or home address)

- Best contact phone number

We apologize for the inconvenience and appreciate you informing us of your concern. We look forward to hearing from you soon!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

Hi @TinaBhere! We understand your concerns about your recent premium increase and have reviewed your two post. The most recent term increased primarily due to a rate revision The Hartford implemented in all states that The Hartford insurance is offered. There’s been a increase in supply chain issues, labor shortages, and the frequency and severity of car accidents. These trends, combined with medical costs continuing to soar, have caused the price of most accidents to rise. It was necessary for The Hartford to increase their prices to keep up with the costs for repairing or replacing damaged vehicles and helping to indemnify those harmed in losses. The increase was approved by each state.

If you were unable to get specific answers as to why your premium increase and what options The Hartford can offer to you to save, we would be glad to work with the Escalation team at The Hartford to have this investigated for you. To do this, we will need more information. At your convenience, please send a private message to provide the following:

- AARP membership number (or home address)

- Best email address & telephone number

- Description of your issue

We apologize for the inconvenience and appreciate you informing us of your concern. We look forward to hearing from you soon!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

And don't forget the average price of cars - new, specifically, but used too, have risen greatly.

Kelly Blue Book 12/12/2022 - Average New Car Price Sets Record

People need to make sure that they are fully insured; adequately insured, because if not, and an accident happens which could be your fault - you are risking financial ruin if not adequately covered.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

AngelaC....I couldn't navigate to you directly, but please call me directly at [EMAIL ADDRESS REMOVED FROM PUBLIC VIEW FOR YOUR ONLINE SAFETY] if you want documentation. I am outraged that my trust in AARP as an org that should represent MY interests, to whom I pay a membership, will endorse and license their name to an insurance company that then CHARGES DOUBLE!!!! this ruins my trust in AARP completely....seems just another marketing scam out for yourselves, taking corporate payola to screw your own members. Please change my mind! fire Hartford and give the AARP endorsement to another more deserving ins company (or do they pay you too much and you just can't turn them down)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

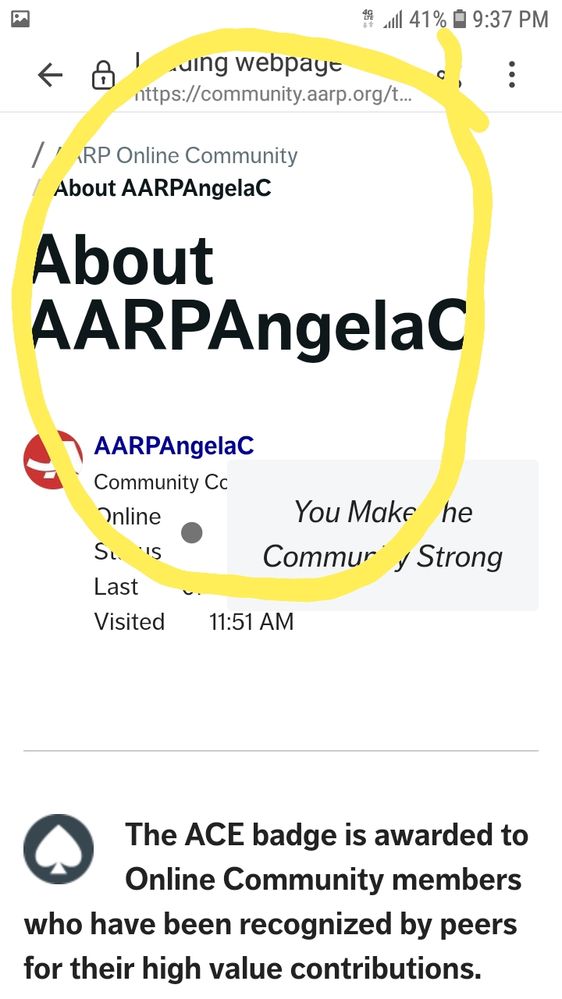

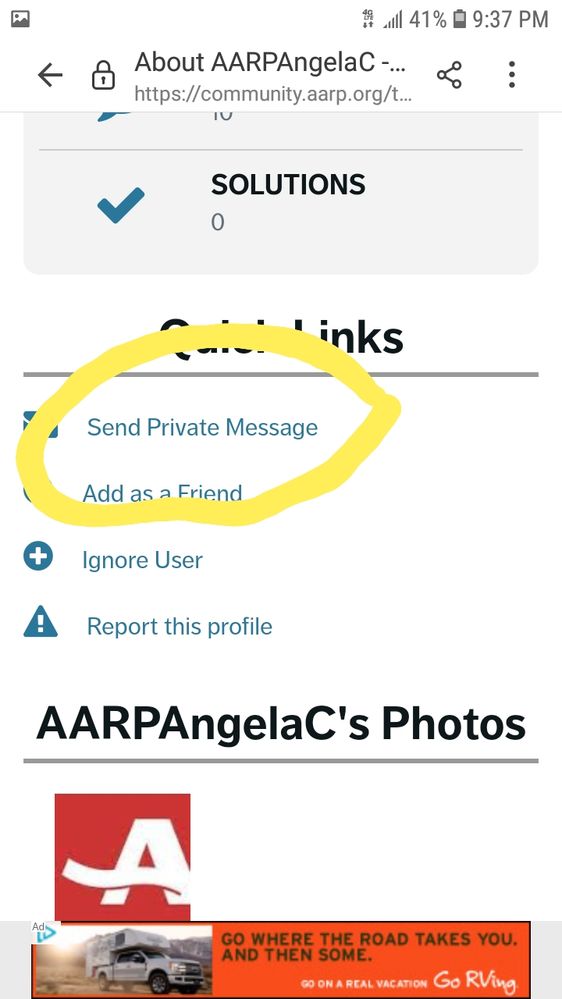

Hi @BillH614618

- Click on @AARPAngelaC .

- This will take you to her AARP Profile.

- Scroll down to bottom and click on <Send Private Message.> This will open up a blank message already going to her. Fill in meesage. Click send.

- Three <screenshots below>.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

I agree with Sammie. My house insurance with Hartford has gone up tremendously. In 2014 it was $1360/year, and for 2021 it is $4,020/year! This is a huge increase for someone who is 78. The house has not changed in size. I did update the kitchen. And now I need a new roof and they are being so difficult. This is my first claim with them. Being an AARP member does not seem to help.

Oh my goodness! NO, this is criminal. I know this is a 2 year old post, but the same thing keeps happening to everyone over and over again. And in your case, that's a $3000 difference. They are obviously trying to take advantage of the elderly. This is absolutely criminal.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

don't just pay the increased rates....that outrageous....get on the net and get cheaper insurance. This is a competitive market economy, get the best deal, save those thousands in ins. savings to buy good food to cook in your new kitchen. AARP has just sold you out....call Allstate, got my insurance reduced more that half.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

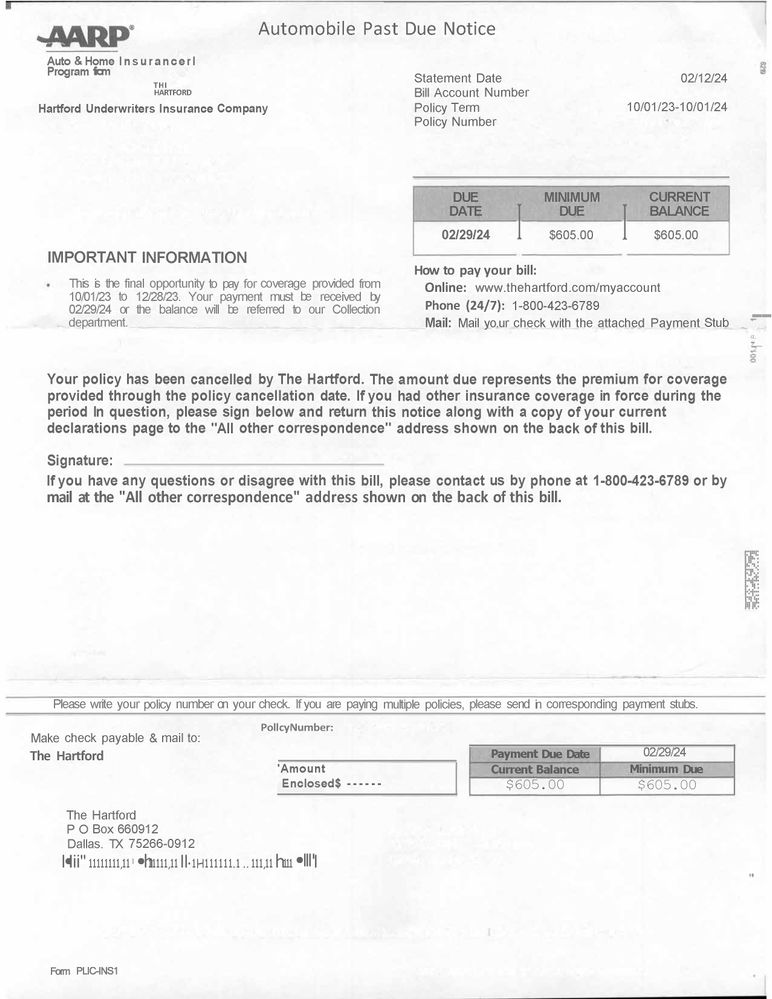

After Hartford jacked my auto insurance way up, I found another insurance company and did indeed get a much better rate. The problem is, Hartford keeps sending me a bill (attached below) even though I did not renew with them. Now they are threatening to send the bill to collections even though I got insurance through another company! Please note the "Important Information" field!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

W're sorry to hear you’re having trouble with The Hartford. We would like the chance to help as soon as possible. Please visit https://help.aarp.org/s/article/contact-aarp to chat, text, or speak with a representative who can get you in touch with our Member Relations team on your behalf. Jodee R.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

Did you do as the invoice directs you to do - send in a copy of the policy (declaration page) of the new policy you picked up?

They just want to see that your new policy whomever it is with begins on 10/01/2023 - the date that your policy lapsed with Hartford.

If you did not have the new one in effect on 10/01/2023 and if you did not cancel the Hartford policy in writing before that date then you were still insured with Hartford and they are just asking you to pay for that coverage period whether or not you used the Hartford policy - because you could have used it if the need arose.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

(2/21/24) Joseph @JosephA563556 have you contacted your STATE whatever who "watches" INSURANCE COMPANIES?🤔

Be careful with Hartford... 😎

[*** JOSEPH @JosephA563556 wrote:After Hartford jacked my auto insurance way up, I found another insurance company and did indeed get a much better rate. The problem is, Hartford keeps sending me a bill (attached below) even though I did not renew with them. Now they are threatening to send the bill to collections even though I got insurance through another company! Please note the "Important Information" field!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

I can't give you a specific explanation EXCEPT that insurance is a shared and shared alike type program and many things will affect your premiums outside of yourself and your specific record.

1. Your age and the age of others in your household who are of driving age. There are many age point increases just like there are increases and decreases in other age / other characteristics in earlier years in our life.

2. The cost of [new and used] vehicles - as these cost rise they affect your premiums because if you hit one, your insurance pays. Repair cost as well as Replacement cost -

3. The amount of traffic, the number of accidents in your general area - your zip code and the surrounding area.

4. The number of people that are UN-insured or UNDER-insured or lack drivers licenses in your general area if you have that coverage on your policy.

5. The number and type of claims in your general area - not just yours - EVERYBODY.

6. Know what extra coverage is added on - stuff like Accident Forgiveness / Declining Deductible

all add to the cost too.

One thing that you didn't mention was under which type of coverage you saw the most increase - Liability, Comprehensive, UN- or UNDER-Insured coverage - both liability and property coverage.

When shopping coverage, you have to compare a lot of different categories for a reasonable comparison: See if you qualify for any discounts or could by taking some type of action.

What about raising your deductible limits? Did your various limits stay the same when you switched before or were these limits raised? Did you pick up or drop any accessory coverage like towing / rental car coverage and are these the same as before.

Once you know what you actually have by deciphering the policy, do an analysis of your existing coverage and then compare [the same or as close as you can] with other companies.

What special member benefits do you get with them by being an AARP member? Make sure you read their details and disclaimers. Are you paying for more things than you might need or don't get in another policy?

https://www.thehartford.com/aarp/car-insurance/aarp-benefits-discounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

When you also add in the loss factors due to climate change that result from natural catastrophes as well as car theft it's not surprising everyone's rates increase. Also if planning on a used car be very careful of cars involved with flood damage. The insurance companies send them to auction houses that dealers pick up and disguises the fact they were flooded. Usually with electrical problems they bandaid but can't be permanently fixed. Once your service agreement ends...your continued out of pocket begins.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

When other auto insurance companies are raising their rates in the neighborhood of 8% in 2023 (over 2022 rates) these small factors you mention spread across millions of customers would never justify the huge rate increases we are seeing upon Hartford first renewal. My base rate adjustment would have been 36.48%. No, it's bait and switch and piracy of many older folks who don't, can't or won't make a switch when they're being screwed. And, the agent tried to placate little-OLD-me by saying "everything is going up - have you been to the grocery store?" As THOUGH I am computer illiterate and can't learn that 36.48% is way out of the ballpark from the normal industry standard rate increase of 8%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report

So this isn’t correct ?

WalletHub 01/20/2023 The Hartford Insurance Review 2023

NEW: AARP Games Tournament Tuesdays! This week, achieve a top score in Bubble Shooter and you could win $100! Learn More.